Hi everyone This is Rahul Chakrapani

We have all seen crazy advertisements on tv and social media every day

where Rahul Dravid KapilDev and other famous people are doing something very fresh and new.

Yes, it’s all about CRED today. the New sensation in India.

The revolutionary Indian fintech company that made billions within a few years

CRED

2 years ago in 2019, the cred was started in India as a small startup like every other startup.

within two years of period, the company have made a 2.2 billion valuation

How come it is possible?

How to scale a company and value 2 billion within 2 years?

youngest Indian startup to reach the milestone of a billion-dollar company.

But did you know that

in 2020 alone CRED had a loss of 360 crore rupees and got only 52 lakh rupees in total revenue?

it means a 492% loss in the year 2019 alone

for every 1 rupee, they have generated, They have spent 727 rupees on it?

to get that sale, that is the expenditure in marketing for CRED.

how so much funding happen with Cred even if they lose money like this?

what’s happened with Cred?

What was Kunal Shah strategy for Cred?

Did you know that so many other companies are operating like this

Jio, Ola, PharmEasy all are operating in the same fashion in India

So let’s try to understand what they are trying to do in Business.

if we can check the business plans of these companies

we can able to understand one thing

all of these companies were working on only one thing in the Indian Market

The behavioural design of the society

it means anticipation of behavioural designs(change) maximises their ability to become a billion-dollar company

behavioural design of the society (anticipated change )

happens in different steps according to all these billion-dollar company business plans.

This process will happen in a few Steps

1 identify a problem

2. designer system to fix that problem

3 . money game (investment )

4 . induce the uses within unbelievable offers

These are the most common steps for all this kind of business plan

Let’s examine this :

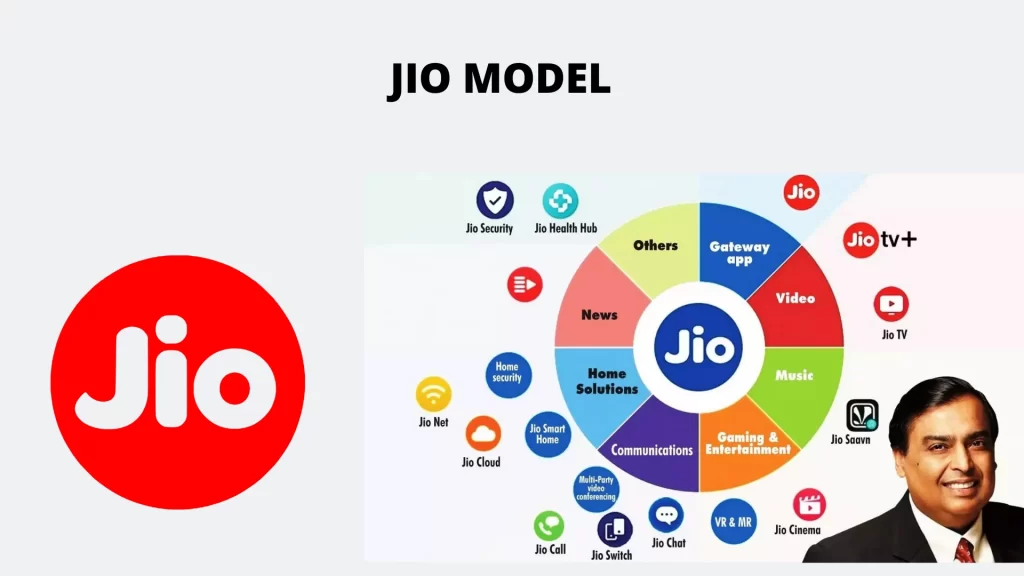

Let’s take an example of jio

when starting in 2016 In India, internet access ability is the main problem

to meet that problem jio was launched (mobile internet)

for this purpose, only Reliance Build a 1.5 crore worth infrastructure only for jio

2016 jio launched

with impossible offers

free sim card, free call, free internet

Offers are like too good to be true offers.

Then what happened

to millions of Indians who Went onto the roads.

Stand in the queues and both the jio sim & jio phones.

Jio has done it maximum to maximize the numbers in sales.

Maximum they have sold their SIM cards.

after the heavy investment in infrastructure,

jio have lost 31 crore rupees in 2016 only

Now let us talk about Cred

Anyone who used to use any credit cards in the past can able to relate with me very fast because using a credit card is s pain in our country.

As customers, we don’t understand what is going on with our credit cards?

Getting a credit card and using it is also the biggest pain.

It is so sophisticated from their terms conditions to repayments

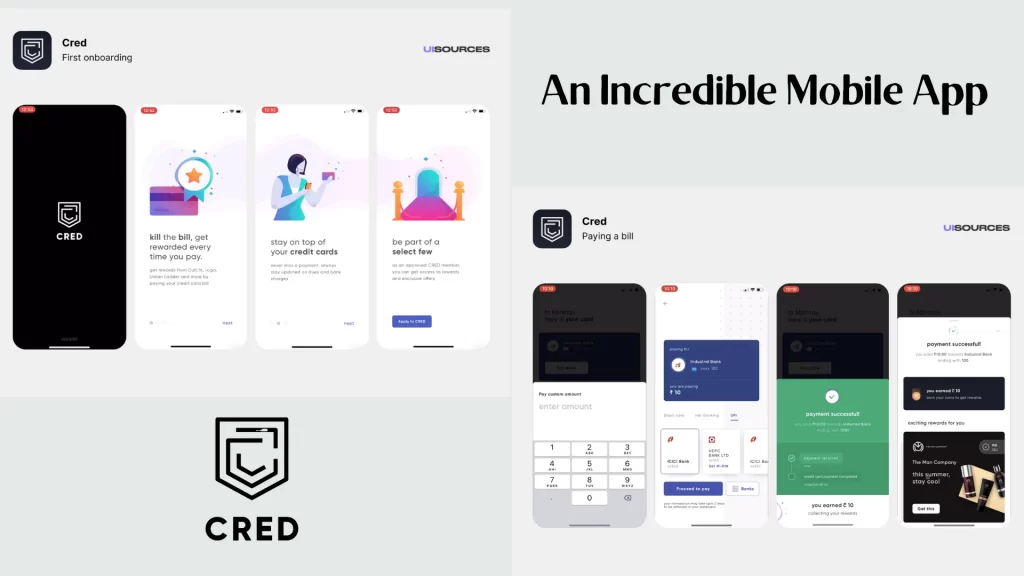

cred was founded on the three pain points of credit card users in India

1 . hidden charges

2. late fees due to forgetfulness

3. extra interest paid to the company’s

This is where CRED comes with an extraordinary business plan

To solve all these problems with their technology and system

After launching CRED in 2019 they have gone like this

Massive cash burn and offers after offers

Massive offers to the customers who signed up in CRED

Up to 1000 rupees cashback and even flight tickets and a lot more

etc are on credit card payments by using CRED.

And the offers list goes on and on and on. today CRED has 30 lakh credit card users.

Within 2 years today, CRED have 20 % of the total credit card premium users in their custody in India,

In a short period, they are gonna gain a lot of customer base in India very fast

The process

Phase 1

incentives to the customers

For getting the customer base into the business,

customer needs to stay in this business for a long period

So that companies can able to make money later.

Phase 2.

Habituation

like in the example of the Jio launch

jio Sim offers free talk time, free data and a lot more

Like that in the case of CRED, a lot of issues was in the credit card segment

CRED simple to use cred stopped using conventional methods statement hidden charges terms and conditions and clauses

For their traditional credit card uses they have no idea where their money is going save the money is loading from some materials.

Phase 3

new normal system

reversibility ( going back to older state )

Let us take an example of Google Maps

This generation doesn’t even bother about any Landmark or street address for anything in their head

because they have Google Maps

finding a way to another place is just an easy task

We don’t have mental space for remembering any place, street, address, landmark, etc in the brain today

because of Google Maps

like CRED users don’t have to remember.

the due date

late fees due to forgetfulness

CRED can solve all issues related to credit cards

Ola Always solved the problem of no need for searching for a taxi on the road. Taxi will come to you.

Jio was solving the problem of internet access ability in India

it changes the behaviour of the consumer.

Like booking a cab paying a credit card bill.

people have that experience of using this beautiful system,

then they don’t want to go back. To the old traditional method.

So what will happen they will never go back.

They will stay in the new normal.

Phase 4

profitability

status the gold mine for any startup business

Like we have seen in the case of jio

Initially, they faced a loss of 31 crores then

jio was profitable after 1.5 years 504 crores

in 2020 Jio had 5562 crores in sales.

When it comes to Karad Karad is a gold mine.

customer of CRED t is the richest 1% of the country,

The people who is having a credit card or multiple credit cards these people are the ideal customer for any top brand in India,

they have a solid income source they might love to spend expensive purchases too,

so the future of CRED is so good.

FUTURE

In the future CRED can be a cash app or a money management app income tax filing app or the system for any sort of this category

Even they can use their customer purchase data. To use it like show them interest-based ads

Moreover, they can act as a bank for the top 1 % Of peoples

The sky is the limit as of now for t Kunal Shah