Hi friends this is Rahul Chakrapani

the retail wars in India are rising to new peaks every single day

on one side we have giants like Reliance Retail and Dmart who are obsessively focused on profits

on the other side, we have new startups like Big Basket Grofers and Udan

who is riding the internet revolution using their scale and software?

but while every single news channel talks about these billion-dollar companies

very few actually talk about the poor state of Kirana stores in our country

with each passing year while D’Mart shares keep going up and the revenue and profits of Kirana stores are touching new lows

to make matters worse we have the pandemic that put thousands of small business owners in debt

sinking them deeper into an already existing crisis

but you know what guys

this is where reliance is bringing a revolution and the instrument of this revolution is none other than Jio Mart

Jio Mart Csae Study

which started its operation in 2020 and the supply chain that they are building is so powerful that they could have both the scale of the big basket

and the massive profits of D’Mart eventually Jio Mart has the potential to become the most powerful player in retail

the best part is that unlike D’Mart or Big Basket, Jio Mart will not become powerful by killing the Kirana stores

but by empowering them to become as powerful as Big Basket and D’Mart

The question is how is it even possible that a Kirana store can compete with giants like Big Basket and D’Mart?

What exactly is Jio Mart’s master plan?

most importantly as investors and students of business

what are the most important factors that we need to keep an eye on to understand the iconic retail wars of India

the first thing you need to understand is how do the players in the retail market operate.

in the first place,

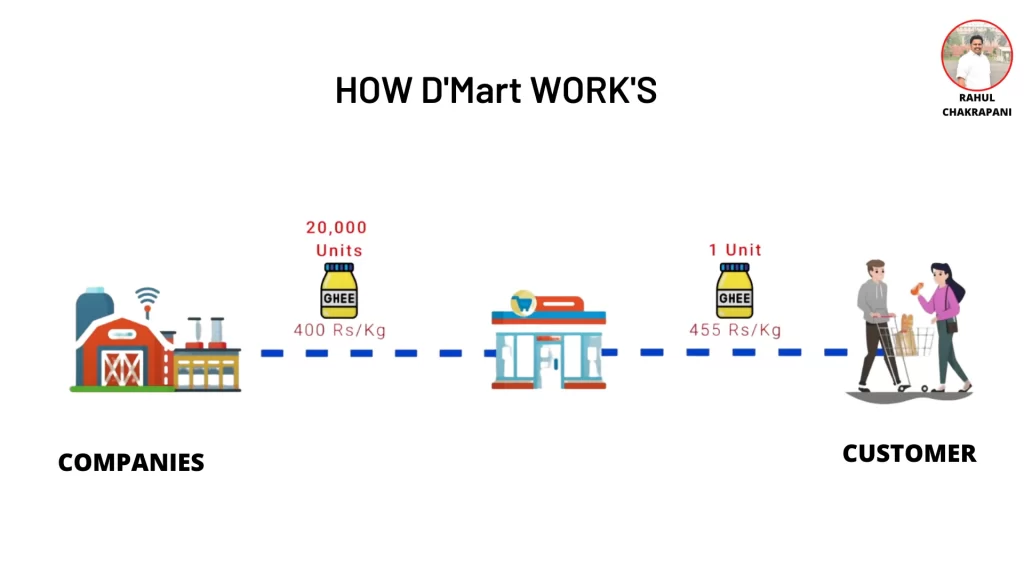

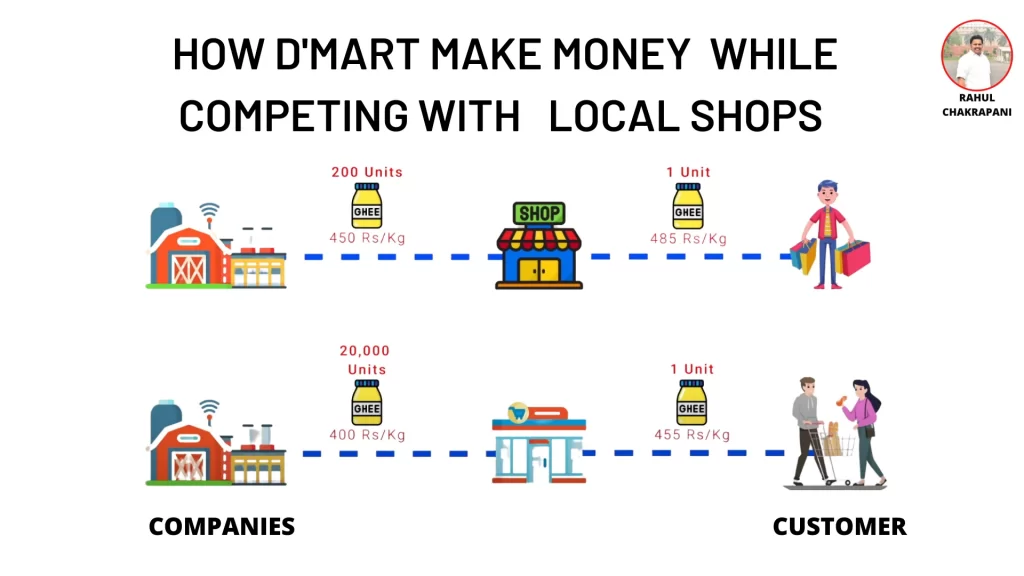

the first player we have is D’Mart and they use the power of discounting to get the commodities at such low rates

that D’Mart selling price is lesser or equal to the cost price of Kirana stores

for example

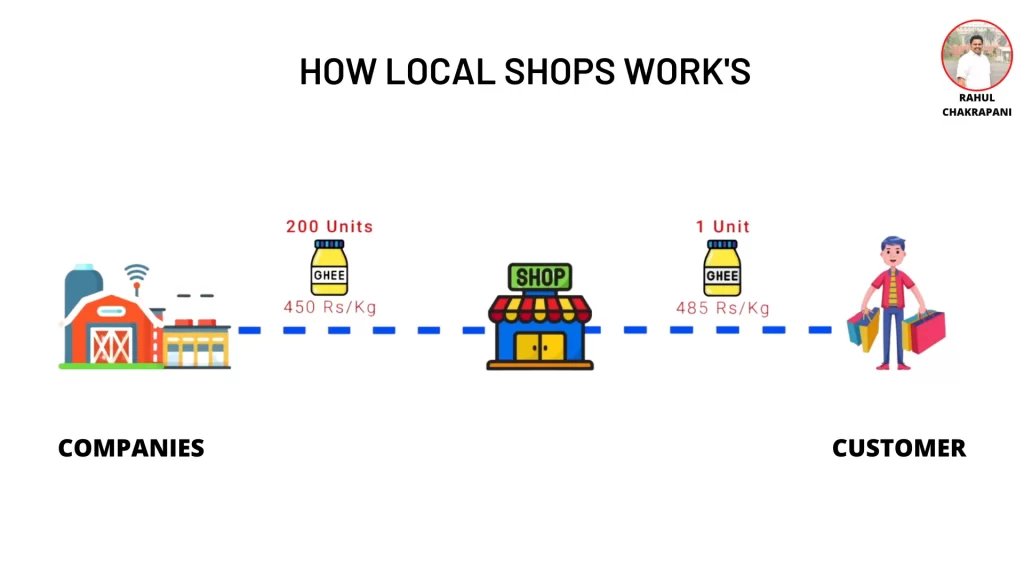

a Kirana store places an order for 200 units of ghee at 450 rupees per kg and sells it at an MRP of 485 rupees per kg

whereas D’Mart places an order for 20000 units and buys the same packet of ghee at 400 rupees per kg eventually sells it at 455 rupees per kg

Therefore

if Kirana stores want to compete with D’Mart they have to sell ghee at a bare minimum profit of 5 rupees which is practically impossible

this is how D’Mart used its massive scale and cash flow to erode the business of Kirana stores

now fortunately or unfortunately going to D’Mart had not been convenient for everyone.

since they started their online very late

the customer segment that preferred convenience over price still went to the nearest Kirana stores

this way the Kirana store still had an essential place in the market

that is where the big basket came in with its online service and a robust supply chain.

now unlike D’Mart,

The big basket did not just use its scale but also built a super-efficient supply chain to deliver these products to every look and corner of the city

therefore customers did not just get the price of D’Mart but also got it home delivered that giving the big basket the extra edge over D’Mart

apart from that big basket has done an incredible job at designing the most sophisticated user interface in the market

and the most powerful tool it has is a big basket daily

and Big Basket daily wants to become such an integral part of your life that it wants to eliminate the very possibility of you going to D’Mart.

this is how big basket and D’Mart have taken away two of the most fundamental pillars of a Kirana store business that are cost and accessibility

they did that using their superpowers of scale and software as a result

our local Kirana stores are facing a nightmare with their incomes dropping with each passing year.

but you know what guys this is where Jio mart came in.

like I said before if Jio Marts business plan is executed properly within some time

even a small Kirana store will become as powerful as D’Mart and Big Basket Time Jio Mart could become bigger than D’Mart and Big Basket combined

so the question is what is this master plan?

What is Jio Mart doing to enable Kirana stores to compete with giants like D’Mart and Big Basket?

the first thing Jio Mart is working on is beating D’Mart in terms of scale and purchasing power

like I said before the reason why Kirana stores cannot compete with D’Mart is that

they do not have the purchasing power to buy 20000 units of ghee which is why they do not have the bargaining power

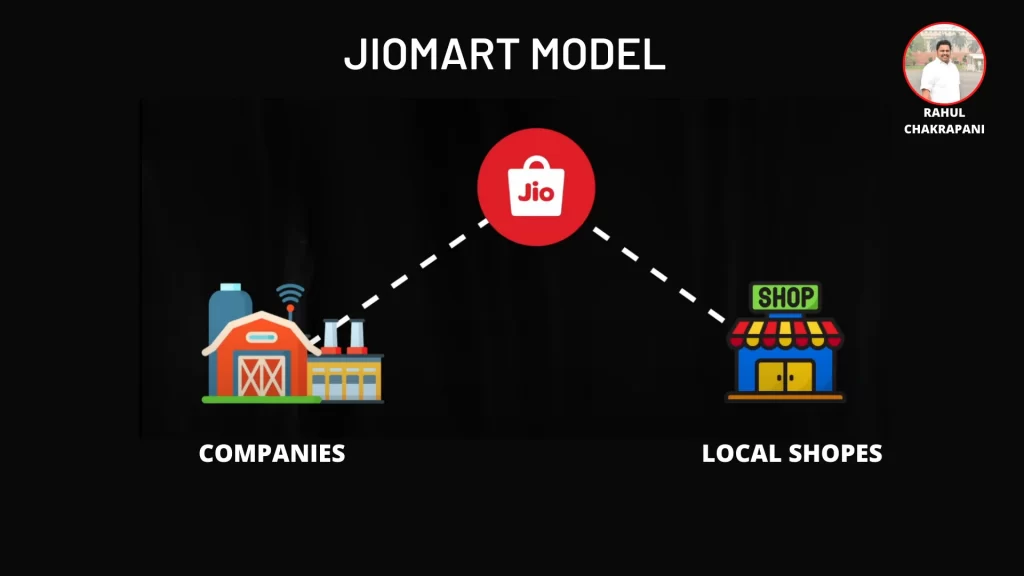

but this is where Jio’s master plan comes in Jio Mart says

Instead of the Kirana stores procuring goods in small quantities,

Jio mart will procure the goods from the FMCG company straight away and become a distributor to the Kirana stores.

for example

Instead of 10 Kirana stores individually buying200 units of ghee from a wholesaler,

Jio Mart will procure 48000 units of ghee directly from the FMCG companies on behalf of 200 Kirana stores.

eventually, it will transport them individually to each one of these stores

this way just like D’Mart bought 20,000 units of ghee for 400 rupees using its purchase power and sells it 455 rupees per kg

Jio Mart will be able to buy 40,000 units of ghee at the same price from the FMCG companies

and then it can sell to the Kirana stores at 420 rupees to 425 rupees per kg.

this will enable Kirana stores to sell the packet of ghee at 455 rupees which is the same price as D’Mart.

this time Kirana stores do not have to sell it at a bare minimum profit of 5 rupees but can get a healthy margin of 25 to 30 rupees now.

this begs the question of how is this going to benefit Jio Mart?

if you see in that example

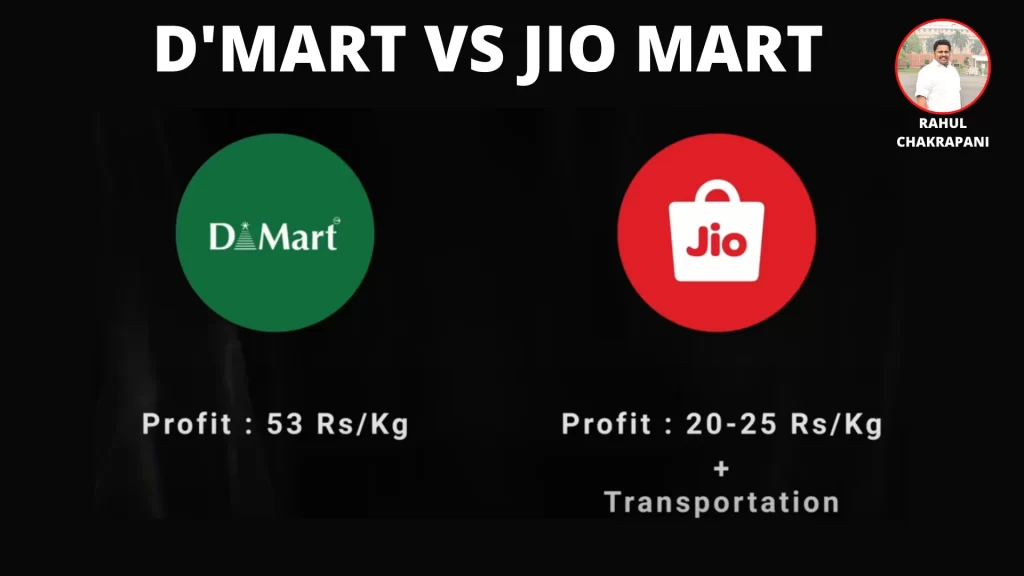

while D’Mart makes a profit of 50 to 55 rupees per kg Jio mart only makes a profit of 20 to 25 rupees and

on top of that, it also has to take care of transportation

but you know what guys this is where we miss out on the huge scalability factor that Jio Mart has over D’Mart.

while D’Mart is serving only 72 cities Kirana stores are present in more than 2500 cities all across the country

Unlike D’Mart Jio does not have to set up a giant store

it just needs to build a logistics system to supply goods to the Kirana stores

and another point to be noted over here is that these Kirana stores will be

complementary entities to the already existing 12000 reliance retail outlets

this is how reliance intends to empower small Kirana stores to stand up against

the likes of D’Mart by turning them into micro-distribution centres

now the question is how is Jio Mart going to beat big basket?

well that is where the second wing comes in

that is software support of Jio Mart

if you search Jio Mart, in the play store you will find two Jio Mart apps

one is Jio Mart t for consumers and the other is Jio Mart for partners

in the first app that is Jio Mart for consumers jio has brought along a professional-grade user interface to help users to place orders

and the vision is that when a customer places an order in the app

the order will be delivered from the nearest Kirana store that has the commodity in stock and this Kirana store will be a Jio Mart Partner

the catch over here is that while big basket expects you to have a minimum

basket value of 500 rupees,

Jio Mart has no minimum order value for home delivery

this is how io Mart intends to use software and aggressive pricing to empower Kirana stores to compete with Big Basket

similarly, the second app enables Kirana stores to place orders directly with Jio Mart

which will enable them to procure goods at a very low cost without having to visit the mandi and without worrying about transportation

this is how Jio Mart intends to deploy its impeccable scale and software to empower the small Kirana stores

all across the country to beat the likes of D’Mart and Big Basket in the next 5 to 10 years

it is expected that small businesses will be empowered enough to become 5 to 30 more profitable despite the competitive pricing

Jio Mart will be able to scale up its accessibility through the lengths and breadths of the country

so on paper, it looks like Jio Mart is on its way to becoming the undisputed king in the grocery market right

well not really

because on the ground there are four critical challenges that Kirana stores are facing with Jio Mart

only if they solve this problem can they actually stand a chance against Big Basket and D’Mart?

What are the crucial factors that will dictate the success or failure of D’Mart in the ongoing retail war in India?

CHALLENGES

critical challenges ahead of D’Mart that will determine the success or the failure of the company in the market

the first challeng

as soon as Kirana stores start ordering from D’Mart they naturally have to cut ties with their existing suppliers now

this is a very big sacrifice because we are talking about a relationship that has been fostered for decades

secondly

one of the most crucial instruments of business for a Kirana store is credit

for example

if you are a Kirana store owner when you buy 30000 rupees worth of products from a supplier

the supplier gives you 15 to 20 days to pay back the money

this way you can sell these products make a profit of 5000 rupees and then pay back the supplier

as soon as a supplier becomes familiar with you they even offer one to two lakh rupees of credit for

15 to 30 days without any pressure of an official Contract

so even with very little capital merely because of the trust factor the Kirana store can do business seamlessly

but in the case of D’Mart

when I spoke to the store owners in my circle they said that

although D’Mart offers lower prices than the suppliers, it does not give them credit,

therefore they need a lot of working capital in hand in order to operate their business

at the same time, Jio Mart initially gives businesses 15000 rupees of credit for 10 days

and as the business grows with time the current amount keeps increasing

but this also means that even if you are running a grocery store for 20 years

you will be treated as a newbie with a credit of only 15000 rupees for 10 days

therefore credit amount and time are critical factors that Jio Mart need to handle

thirdly

as far as my research goes Jio Mart is not fulfilling delivery

for the Kirana stores so rolling that out again is going to be an execution challenge

but until then the small business owners will again need more working capital

Finally

Jio Mart is planning to onboard Kirana stores to turn them into Jio Mart exclusive stores and in this partnership,

Jio Mart will turn a small Kirana store into a premium looking mini shopping centre where customers can walk in and take products from the rack in return,

Jio Mart will make sure that any online order within a particular radius from the Jio Mart app will go to that particular Jio Mart exclusive store

this way small Kirana stores will start acting as micro-distribution hubs for Reliance Retail

now again while this looks lucrative on paper

it comes with the condition that business owners need to pay for the equipment needed for the transformation but along with that they also offer six years of EMI option

secondly, all goods must be bought from Jio Mart unless the prices are lower at the mandi or other suppliers

thirdly,

there is nothing officially mentioned about the store credit system

lastly,

the delivery has to be fulfilled by the Jio Mart partner himself so working capital plus extra delivery staff will be very difficult to afford.

for small business owners, these are the four on-ground challenges that Jio Mart needs to tackle if it wants to beat the likes of Big Basket and D’Mart